A forex quote may be either direct or indirect. The direct quote is the most straightforward because it gives you the number of foreign currency units that you need to purchase your local currency. To calculate the correct price for a European citizen traveling to the USA to purchase goods that are more than $100 USD you can simply divide the prices into units of 1.235656. To get an exact conversion for an indirect quote, you would need to do more math.

Bid price is considered the highest price

Financial markets play an important part in determining the bid and ask price. Bid refers to the price at what a buyer is willing buy a currency. Ask is the price that a seller will sell it for. The spread is the difference between the bid and ask prices of a currency. Spreads are more stable assets if they are smaller. The spread will be increased if the bid is higher.

The lowest price is the ask price

What is the difference in the ask and bid prices for forex trading? The ask price refers to the minimum price a seller would accept and the bid to the maximum price a buyer would pay. The offer happens when both parties agree on a price. The minimum price is the price that you will ask for when you negotiate. If neither side is willing to accept it, the bid will be the best.

Percentage in Point is the smallest unit value within a forex quotation.

Percentage in point, or pip, is the smallest unit of value within a forex quote. Pip, which is the smallest unit value in a forex quotation, is used to price currency pairs up to four decimal points. Two additional units are also used in the forex market, ask and bid, to describe currencies' values. These units are often referred to by the symbol 'pip/pip'.

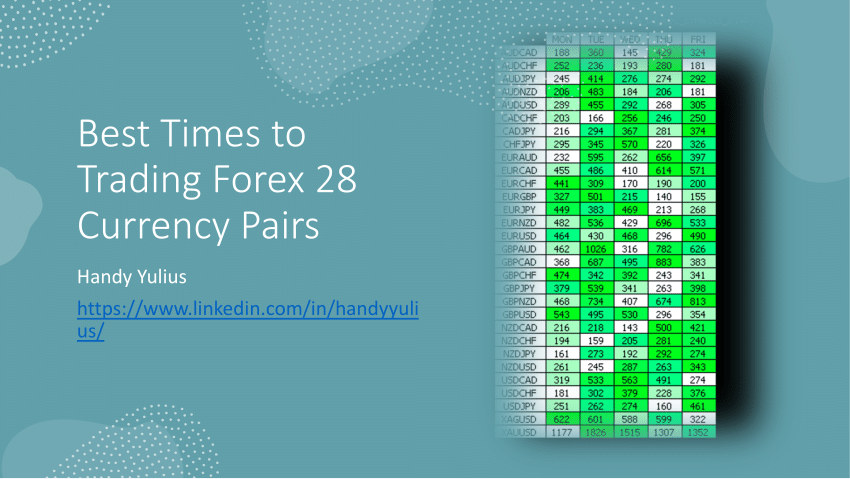

Forex quotes can include currency pairs

You might wonder, "What is a forex quote made up of currency pairs?" Two currencies are either similar in value or they are different currencies. These are called currency pairs and are usually written with a slash between base and quote currencies. The USD against the EUR is a common example of a currency pairing. One USD unit would equal 1.14020 EUR units.

Interpreting a forex quotation

Interpreting forex quotes can be difficult. There are many ways to display the forex quote. To properly interpret them, you need to have a basic understanding about the currency pairs. Let's take a look at some of the options. The first way is to display the quotation as an exchange-rate, which indicates how much a specific currency is worth in the currency base. The quotation can also be displayed as a cost.

FAQ

What age should you begin investing?

On average, $2,000 is spent annually on retirement savings. Start saving now to ensure a comfortable retirement. You might not have enough money when you retire if you don't begin saving now.

You should save as much as possible while working. Then, continue saving after your job is done.

The sooner you start, you will achieve your goals quicker.

You should save 10% for every bonus and paycheck. You might also be able to invest in employer-based programs like 401(k).

Contribute at least enough to cover your expenses. You can then increase your contribution.

Which investments should I make to grow my money?

You should have an idea about what you plan to do with the money. It is impossible to expect to make any money if you don't know your purpose.

You should also be able to generate income from multiple sources. So if one source fails you can easily find another.

Money doesn't just come into your life by magic. It takes planning and hardwork. So plan ahead and put the time in now to reap the rewards later.

How long does a person take to become financially free?

It depends on many things. Some people can become financially independent within a few months. Others may take years to reach this point. No matter how long it takes, you can always say "I am financially free" at some point.

You must keep at it until you get there.

Which investments should a beginner make?

Investors who are just starting out should invest in their own capital. They should learn how manage money. Learn how retirement planning works. Learn how budgeting works. Learn how to research stocks. Learn how to interpret financial statements. Avoid scams. You will learn how to make smart decisions. Learn how to diversify. Learn how to guard against inflation. How to live within one's means. Learn how wisely to invest. You can have fun doing this. You'll be amazed at how much you can achieve when you manage your finances.

What type of investment vehicle do I need?

There are two main options available when it comes to investing: stocks and bonds.

Stocks are ownership rights in companies. They are better than bonds as they offer higher returns and pay more interest each month than annual.

You should focus on stocks if you want to quickly increase your wealth.

Bonds, meanwhile, tend to provide lower yields but are safer investments.

Keep in mind that there are other types of investments besides these two.

They include real property, precious metals as well art and collectibles.

Do I need to know anything about finance before I start investing?

You don't require any financial expertise to make sound decisions.

All you really need is common sense.

Here are some tips to help you avoid costly mistakes when investing your hard-earned funds.

Be cautious with the amount you borrow.

Don't fall into debt simply because you think you could make money.

Be sure to fully understand the risks associated with investments.

These include inflation and taxes.

Finally, never let emotions cloud your judgment.

Remember that investing doesn't involve gambling. It takes skill and discipline to succeed at it.

These guidelines are important to follow.

Statistics

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- They charge a small fee for portfolio management, generally around 0.25% of your account balance. (nerdwallet.com)

- If your stock drops 10% below its purchase price, you have the opportunity to sell that stock to someone else and still retain 90% of your risk capital. (investopedia.com)

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

External Links

How To

How do you start investing?

Investing refers to putting money in something you believe is worthwhile and that you want to see prosper. It's about having confidence in yourself and what you do.

There are many ways to invest in your business and career - but you have to decide how much risk you're willing to take. Some people like to put everything they've got into one big venture; others prefer to spread their bets across several small investments.

Here are some tips to help get you started if there is no place to turn.

-

Do your homework. Find out as much as possible about the market you want to enter and what competitors are already offering.

-

It is important to know the details of your product/service. You should know exactly what your product/service does, how it is used, and why. You should be familiar with the competition if you are trying to target a new niche.

-

Be realistic. Before making major financial commitments, think about your finances. If you are able to afford to fail, you will never regret taking action. You should only make an investment if you are confident with the outcome.

-

You should not only think about the future. Consider your past successes as well as failures. Ask yourself what lessons you took away from these past failures and what you could have done differently next time.

-

Have fun. Investing shouldn’t cause stress. Start slow and increase your investment gradually. Keep track of both your earnings and losses to learn from your failures. Keep in mind that hard work and perseverance are key to success.